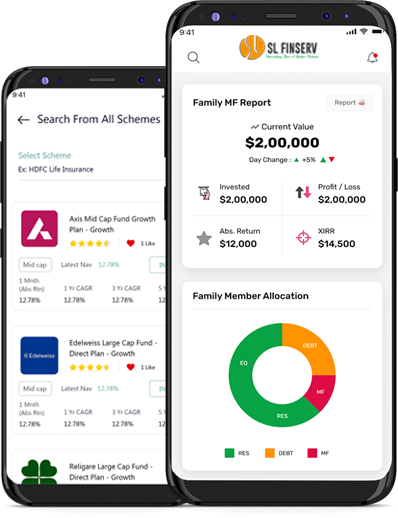

About Us

At SL Finserv , we provide most trusted investment consultancy to the investor whereby we take care of investors for their entire goal based financial needs. We are experienced in handling all needs with elaborated discussions and understanding of our investors We provide genuine and trusted financial advice & that too is based on our understanding of investors present and future financial objectives, obligations, & needs of cash flows if any. It also involves discussions of investor’s present financial risk acceptance level.

About us